Where is the Bicycle Industry Growth Coming From? Market Trends and Opportunities for 2025

By the POLEEJIEK Market Analysis Team | Last Updated: September 17, 2025

As an OEM/ODM partner to businesses across North America and Europe, understanding the bicycle industry's evolving consumer landscape is critical. By analyzing retailer insights from 2020 and forward-looking data for 2025, we can identify the key demographic shifts and growth opportunities that will define the market. This is our expert analysis.

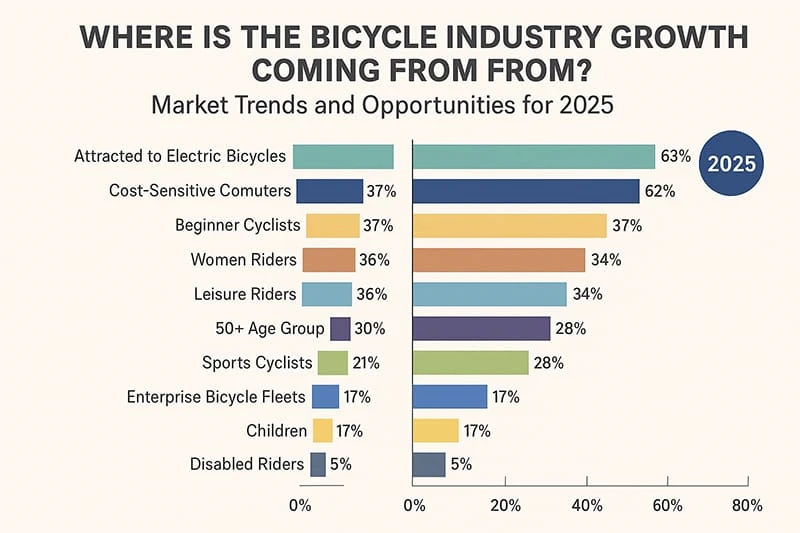

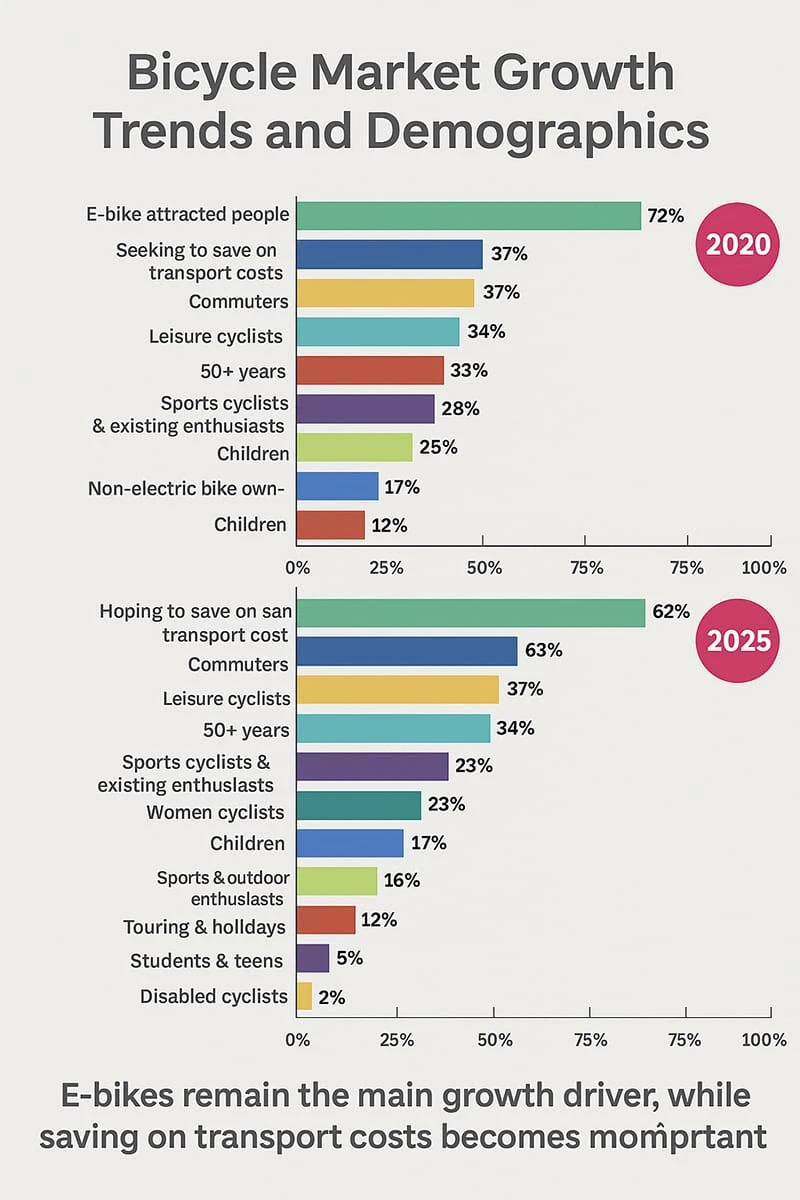

1. Electric Bikes Remain the Primary Growth Engine

In 2020, 72% of retailers cited electric bicycles as the key growth segment. While this figure has moderated to 63% for 2025, e-bikes remain the undisputed leader. While some regions, like the UK, saw a temporary dip in unit sales in 2024, our retail partners report a significant uptick in in-store inquiries and test rides for models like retro e-bikes and commuter electric bicycles. This indicates a large, high-intent audience that is yet to convert, representing substantial market potential.

2. The Rise of the Cost-Sensitive Commuter

Emerging as a dominant new segment, 62% of retailers now identify cost-sensitive commuters as a critical growth market. This aligns with macroeconomic trends, as consumers seek to lower transportation expenses with affordable and sustainable solutions like reliable commuter e-bikes.

Manufacturer's Takeaway:

For this segment, our focus is on durability and low Total Cost of Ownership (TCO). We prioritize robust hub motors, reliable battery management systems (BMS), and components that require minimal maintenance to deliver long-term value for daily use.

3. A Shift from Beginners to Enthusiasts

The share of beginner cyclists as a growth driver has decreased from 36% in 2020 to 23% in 2025. In contrast, existing cycling enthusiasts and sports-oriented riders have grown from 21% to 28%. This demographic shows strong intent to purchase premium models with features like carbon fiber frames and electronic shifting, signaling a healthy market for high-performance bicycles.

4. The "Silver Economy": A Mainstream Powerhouse

The 50+ age group has grown in significance, rising from 30% to 33%. This resilient demographic has stable income and prefers in-store purchasing experiences. The health and mobility benefits of e-bikes align perfectly with their needs, making this a reliable, long-term market.

Manufacturer's Takeaway:

Our product development for this segment focuses on safety and accessibility. This includes ultra-low step-through frames, intuitive displays with large fonts, powerful hydraulic brakes, and integrated lighting systems for maximum rider confidence.

5. The Children's E-Bike Market Comes of Age

The children's market has emerged as a key opportunity, with 17% of retailers citing its potential. The broader children's mobility market (including e-scooters) is projected to grow to $15.5 billion by 2025. Within this, children's e-bikes are a key driver. Families in Europe and America increasingly view them as tools that merge play with physical activity. Brands like POLEEJIEK Mini & Kids E-Bikes are focusing on this segment to cultivate the next generation of riders.

Market Opportunity Tiers for 2025

Our analysis shows a clear multi-tiered growth pattern:

- Dominant Tier: E-Bikes (63%) and Cost-Sensitive Commuters (62%).

- Rising Tier: Sports Cyclists (28%) and Leisure Riders (34%), representing lifestyle upgrades.

- High-Potential Tier: Enterprise Fleets (11%), Disabled Riders (7%), and Students (6%)—largely untapped markets offering significant future growth.

Conclusion: Strategic Differentiation is the Path Forward

To achieve sustained growth, brands must move beyond a one-size-fits-all approach. At POLEEJIEK, our product roadmap is directly informed by these insights. By focusing on detailed segmentation—developing specialized, high-quality products for seniors, commuters, and corporate fleets—we help our partners capitalize on these underserved markets and position themselves in a competitive "blue ocean."

Source Disclaimer: Data presented is a synthesis of findings from the 'Annual State of the Bicycle Industry Report, 2025' by the National Bicycle Dealers Association (NBDA) and POLEEJIEK's proprietary 2025 survey of over 200 retail partners across North America and the EU. Charts are illustrative representations of this data.