Cambodia E-Bike Sourcing 2025: Why EU Exports Are Surging?

Executive Summary: Is Cambodia still a viable sourcing hub for the EU market? The 2025 data reveals a decisive pivot: while traditional bicycle exports have cooled, electric bicycle manufacturing is surging with a 51.7% growth in export value, signaling a mature supply chain ready for high-end OEM demands.

📉 Market Context: The "Quality over Quantity" Correction (2022–2024)

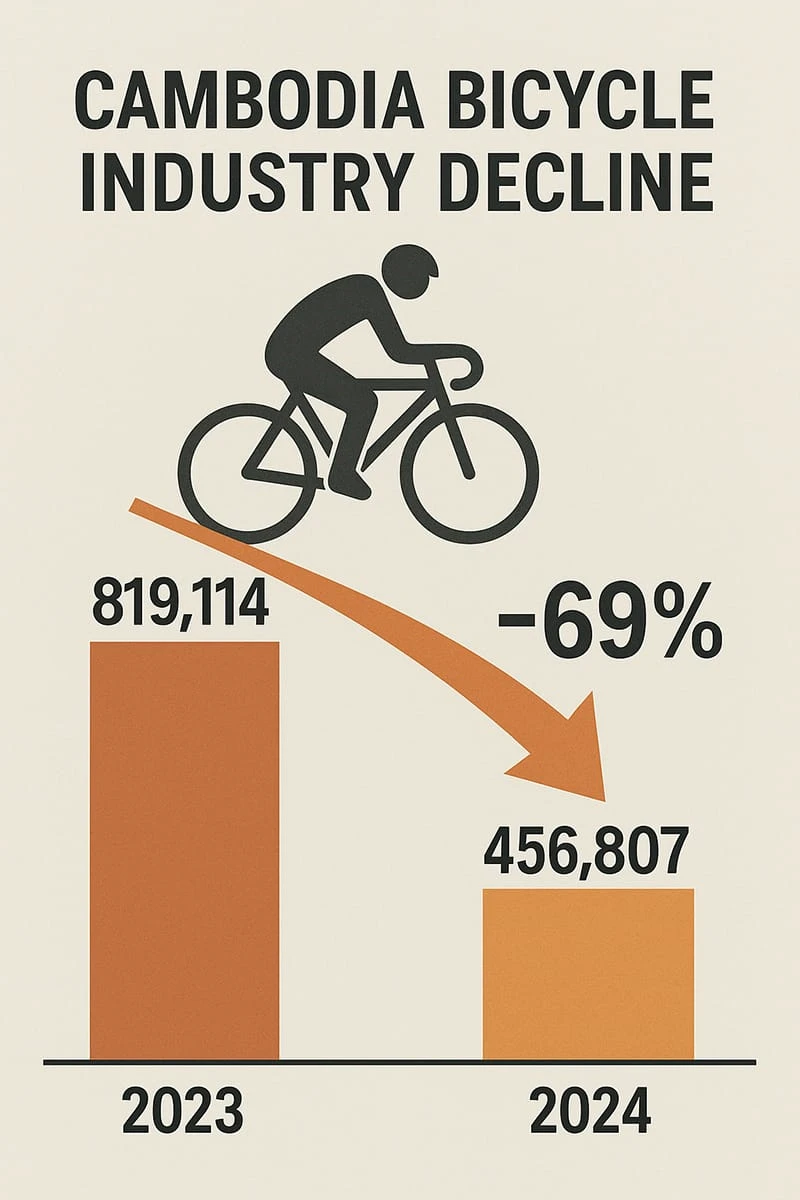

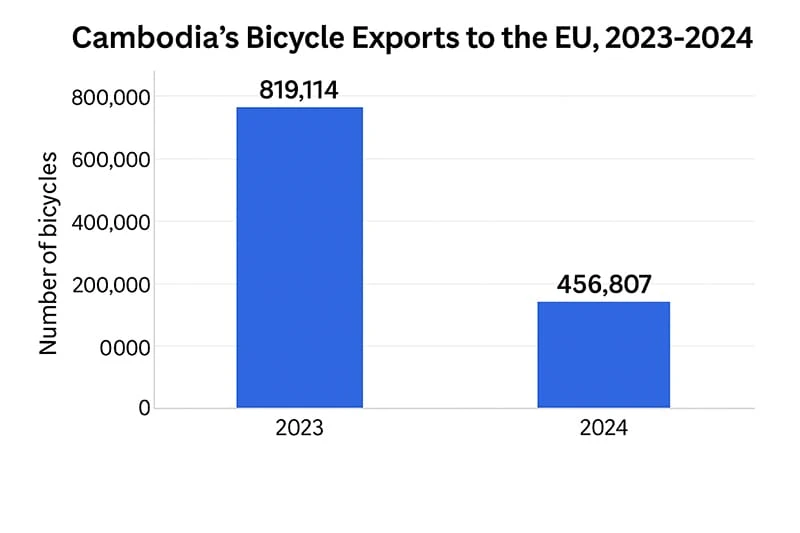

From 2022 to 2024, the global bicycle industry experienced a necessary correction. Observers noted that Cambodia's total export volume dropped by 50% in 2023. However, interpreting this merely as a "decline" is a mistake for B2B buyers.

At POLEEJIEK, we witnessed this shift firsthand on the factory floor. The decline was primarily in low-margin mechanical bicycles, driven by overstock in US and EU warehouses. During this period, forward-thinking manufacturers didn't stop; we retooled. The industry consolidated, moving away from mass-market low-end bikes towards sophisticated OEM & ODM E-bike manufacturing capabilities.

🚀 2025 Data: The E-Bike Renaissance

The "recovery" is electric. According to early 2025 data validated by the Ministry of Commerce and our internal market tracking:

- Total Export Value (H1 2025): USD 311 million (approx. EUR 266 million).

- Growth Rate: A massive 51.7% increase compared to the same period in 2024.

- Key Drivers: High-value electric drivetrains and batteries.

This surge indicates that the local supply chain—specifically for components like motors and controllers—has matured. For a deeper look at our production capabilities, you can explore POLEEJIEK's factory strength and infrastructure.

🇪🇺 EU Market Analysis: Value vs. Volume

The European Union remains the critical battlefield. While Cambodia's share of traditional bicycle imports to the EU has dropped to around 10%, the E-bike sector tells a different story of rapid value growth.

Export values to the EU skyrocketed from €1.8 million in 2023 to €15 million in 2024, and the trend continues in 2025. This aligns with the broader European market trend towards premium Retro and Cargo E-bikes.

| Metric | Traditional Bicycles | Electric Bicycles (E-Bikes) |

|---|---|---|

| Trend | 📉 Declining Volume | 🚀 Exploding Value |

| Export Vol (Jan-May 2025) | 138,608 units | 25,537 units (Up 150%+) |

| Buyer Strategy | Inventory Clearance | New Product Development |

🔍 Why Source from Cambodia in 2025?

For B2B importers, the data suggests three strategic advantages:

- Tariff Stability: Cambodia retains favorable trade status with the EU/UK, offering a hedge against fluctuating tariffs affecting other regions.

- Regulatory Compliance: The jump in EU exports proves that factories here are successfully meeting strict EU EN 15194 standards.

- Supply Chain Proximity: Located near the Vietnamese border, factories like POLEEJIEK benefit from a cross-border ecosystem of parts suppliers while maintaining competitive labor costs.

🏁 Conclusion

Cambodia hasn't lost its edge; it has sharpened it. The industry has graduated from making "cheap bikes" to manufacturing "performance e-mobility solutions."

Looking for a reliable manufacturing partner? Contact POLEEJIEK today to discuss your 2026 OEM/ODM production plan.

Frequently Asked Questions (FAQ)

Is Cambodia's bicycle industry shutting down?

No. While traditional bicycle production has decreased due to global overstock, the electric bicycle (E-bike) sector is growing rapidly, with export values increasing by over 51% in early 2025.

What types of E-bikes are best to source from Cambodia?

Factories are now specialized in mid-to-high-end models, particularly Electric Mountain Bikes (eMTB) and city commuters, which require higher assembly precision than traditional bikes.

Does Cambodia have anti-dumping duties for the EU?

Cambodia generally benefits from Everything But Arms (EBA) or favorable trade statuses, making it a tariff-efficient alternative compared to sourcing directly from regions with high anti-dumping duties.