Germany E-Bike Market Strategy: Dealer Density & B2B Entry Guide

Germany remains the "engine room" of the European e-bike market, with the ZIV (Two-Wheeler Industry Association) reporting over 800,000 e-bikes sold annually. However, the market is saturating in key areas. For B2B distributors and importers, success in 2025 isn't just about importing bikes; it's about understanding Dealer Density Dynamics and the specific regulatory landscape (EN 15194) to avoid costly inventory stagnation.

📈 Dealer Density Data: Interpreting the Saturation

Industry data correlates dealer density (dealers per 100k residents) with local competition levels. The rankings reveal distinct market behaviors:

- 1. Münster (15.31) – High Saturation: Dominated by traditional city bikes; difficult for new generic brands to enter without a USP.

- 2. Karlsruhe (13.30) – Strong tech/university demographic, open to innovation.

- 3. Cologne (13.28) – Competitive urban commuter market.

- 4. Bielefeld (11.46) – The historic heart of German bike manufacturing.

- 5. Hannover (10.76) – Balanced mix of retail and service centers.

- 6. Berlin, Frankfurt & Munich (Lower Density): High rents favor large flagship stores or D2C (Direct-to-Consumer) models over small shops.

Strategic Insight: High-density cities require "Niche Differentiation" (e.g., Cargo or Retro styles) to compete for shelf space. Lower-density metros offer opportunities for "Service Partner" models where online sales meet offline maintenance.

🌍 The "Blue Ocean": Leasing & Corporate Fleets

Beyond simple retail geography, the German market is driven by the "Dienstrad" (Company Bike Leasing) model (e.g., JobRad). Distributors targeting regions with large corporate HQs—like Frankfurt or Stuttgart—can bypass crowded retail floors by pitching B2B fleet solutions directly to companies, a segment where dealer density matters less than mobile service capability.

💡 Strategies for E-bike Distributors

1. Competing in High-Density Zones (Red Ocean)

In saturated markets like Münster, "generic" e-bikes fail. Distributors must introduce High-Spec, High-Margin products. Positioning torque-sensor equipped mid-drive ebikes (competing with Bosch systems) or specialized Cargo bikes allows independent dealers to offer alternatives to big brands.

2. Compliance as a Sales Tool

German dealers are risk-averse. To expand, distributors must guarantee compliance. This means strictly adhering to the 250W / 25km/h limit (EN 15194) for standard Pedelecs. Marketing illegal 750W bikes as "city commuters" will disqualify you from serious B2B partnerships. Use high-power models only for the "S-Pedelec" (45km/h) niche or private land use sectors.

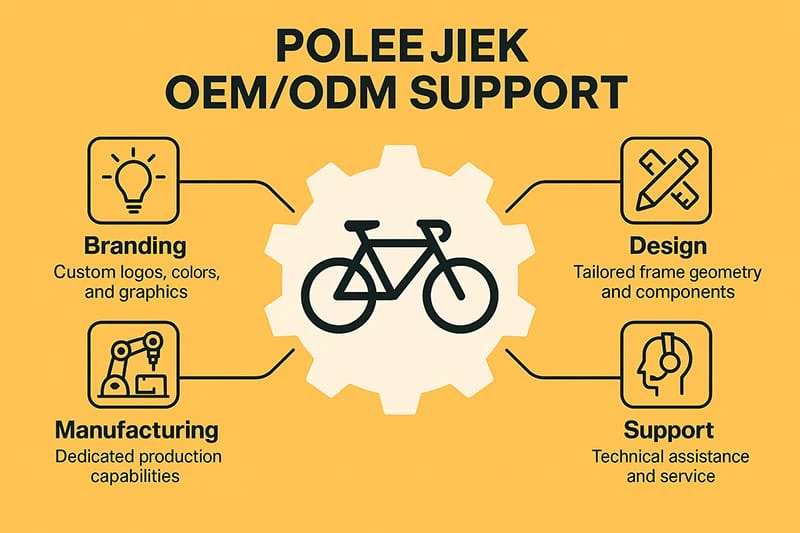

✅ How POLEEJIEK Secures Your German Market Entry

At POLEEJIEK, we manufacture specifically for the nuances of the DACH region (Germany, Austria, Switzerland):

- ✔️ EN 15194 Compliance: 250W motors locked to 25km/h for legal street use.

- ✔️ Niche Power Options: 500W-1000W motors available strictly for S-Pedelec (L1e-B) or off-road SKUs.

- ✔️ German Aesthetic: Minimalist colorways and internal cable routing preferred by local buyers.

- ✔️ Category Variety: From Cargo E-bikes (subsidized in many German cities) to compact Folding models for multi-modal commuting.

- ✔️ Documentation: Full CE reports and Battery UN38.3 certs for smooth customs clearance.

- ✔️ Logistics: Reliable global shipping with reinforced packaging to minimize transit damage.

Whether you are supplying a chain of dealers in Cologne or building a B2B leasing fleet in Berlin, POLEEJIEK provides the engineered quality and legal compliance required to succeed.

📞 Ready to Enter the German Market?

Don't guess on compliance or strategy. Contact our team to request our German Market Spec Sheet and discuss OEM customization.