E-Bike Market Downturn in 2025: Challenges & Growth for the Electric Dirt Bike for Adults

Against a backdrop of sluggish growth in the global bicycle industry, the traditional bicycle market remains under pressure. Even the electric bicycle sector, once seen as a lifeline, has not shown a strong recovery, a fact reflected in the revenues of major manufacturers.

Key Takeaways

-

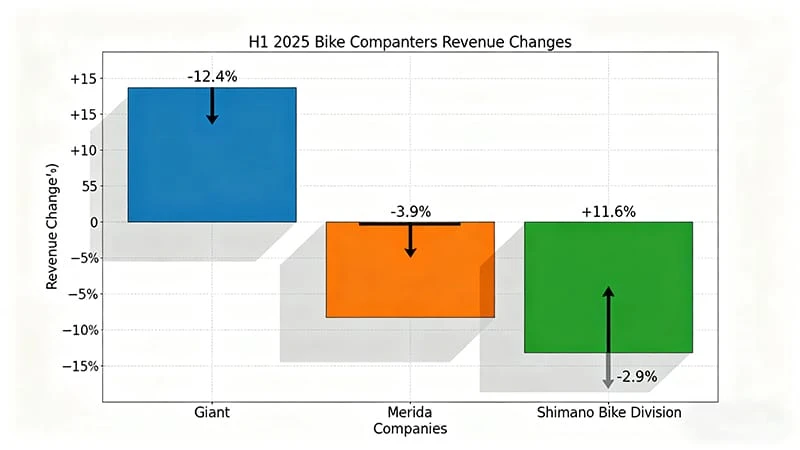

Major bicycle manufacturers like Giant and Merida have seen their revenues decline in the first half of 2025. Shimano's bicycle division saw increased revenue but lower operating profits, indicating squeezed profitability.

-

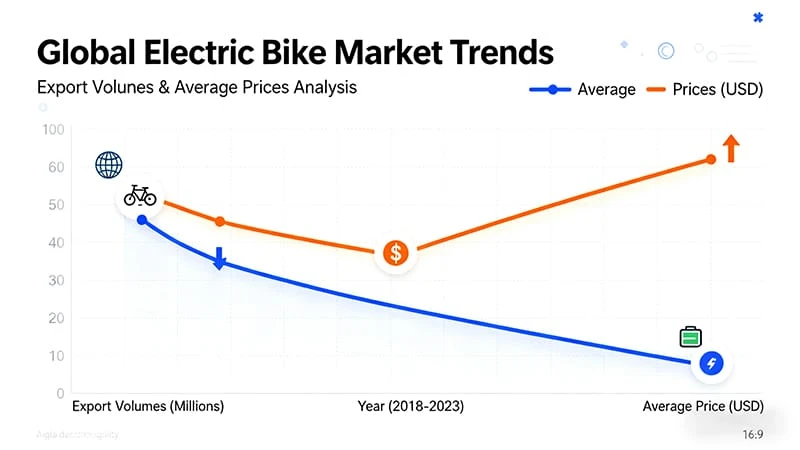

E-bike export volumes are down. For instance, Taiwan’s e-bike exports fell by 11.6% in the first seven months of the year, although higher average prices have cushioned the financial impact.

-

The e-bike market faces significant challenges from trade policies, such as EU anti-dumping duties on Chinese e-bikes, and geopolitical conflicts that disrupt supply chains for key components.

-

In response, companies are regionalizing supply chains, with "Made in Europe" becoming a key selling point for mid-to-high-end electric bikes, including the specialized electric dirt bike for adults.

-

Despite short-term pressures, the long-term outlook remains positive due to government support for green transportation, the rise of e-bikes in urban logistics, and ongoing technological innovation.

Widespread Decline in Bicycle Manufacturer Performance

Financial Performance

Industry giant Giant saw its revenue for the first half of 2025 fall by 12.4% to NT$32.61 billion. During the same period, Merida's consolidated revenue decreased by 3.9% year-on-year to NT$14.57 billion. Meanwhile, although the revenue of Shimano's bicycle division in Japan grew by 11.6% to 181 billion yen, its operating profit declined by 2.9%, reflecting pressure on profitability.

Overall export data tells a similar story.

|

Company |

Period |

Revenue / Profit Change |

Notes |

|---|---|---|---|

|

Giant |

H1 2025 |

-12.4% Revenue |

Revenue dropped to NT$32.61 billion. |

|

Merida |

H1 2025 |

-3.9% Revenue |

Revenue dropped to NT$14.57 billion. |

|

Shimano (Bike Division) |

H1 2025 |

-2.9% Operating Profit |

Despite an 11.6% increase in revenue. |

Export Market Trends

Taking Taiwan as an example, from January to July this year, its global export volume of electric bicycles fell by 11.6%, from 231,580 units last year to 204,718 units this year. Although the total export value saw a smaller decline of 5.1%, from $423.1 million to $401.5 million, this superficial resilience is more a reflection of inflation than an actual recovery. The average unit price rose by 7.35% year-on-year, from $1,827 to $1,961, indicating that manufacturers are relying on higher-value models, such as the premium electric dirt bike for adults, to buffer the impact of reduced orders.

According to Eurostat data, EU electric bicycle imports in the first half of 2025 amounted to 312,000 units, a year-on-year decrease of 9%. The import value in the second quarter was approximately €180 million, a decrease of 18% year-on-year. Furthermore, Taiwan's total exports to the EU remain below pre-pandemic levels of 2019.

Tip: While demand for higher-priced e-bikes remains relatively stable, the growth momentum from electrification is clearly weakening across the board.

E-Bike Market: Challenges, Transitions, and Long-Term Opportunities

Severe External Pressures

The e-bike market is facing severe external pressures. In terms of trade policy, the EU has imposed anti-dumping duties on electric bicycles made in China, with tariffs on some components reaching as high as 79.3%. This has severely impacted European brands like Decathlon and Canyon, which rely on Chinese OEMs/ODMs, forcing them to rethink their supply chains. The UK's independent tariff policy after Brexit has also created uncertainty, with local brands like Brompton publicly stating that relaxing tariffs would harm local manufacturing.

-

Geopolitical Conflicts: Tense US-China trade relations, the Russia-Ukraine war, and the Red Sea crisis have increased Eurasian shipping costs and logistical pressures.

-

Component Dependency: Key components—such as mid-to-high-end motors from Bafang and Ananda, batteries, and control systems—remain highly dependent on Asian suppliers. This poses a significant risk for brands focused on the European market.

The Shift to Regional Supply Chains

In response, a growing number of brands are actively pursuing supply chain regionalization. For example, component suppliers like Bosch eBike Systems and Mahle Smartbike Systems have established factories in Eastern Europe to reduce their reliance on Asian manufacturing. Such initiatives not only help circumvent high tariffs and lower transportation costs but also qualify for EU policy subsidies and ESG benefits, enhancing product value and market competitiveness.

Note: Amid the wave of manufacturing reshoring, "country of origin" has gradually become a new competitive benchmark. "Made in Europe" is becoming a core selling point for mid-to-high-end electric bicycle brands.

Positive Long-Term Outlook

Despite short-term pressures, the long-term prospects for the e-bike market remain optimistic. The EU and various national governments continue to promote green transportation policies, stimulating demand through purchase subsidies, tax credits, corporate energy-saving incentives, and infrastructure investments like dedicated bike lanes and parking stations. In countries like Germany, France, and the Netherlands, e-bikes have become a primary mode of commuting.

Moreover, electric cargo bikes show significant advantages in urban short-distance transport and "last-mile logistics." Several major e-commerce and logistics companies, such as DHL, Amazon, and Gorillas, have widely adopted e-Cargo bikes to improve delivery efficiency and meet low-carbon transition goals. In the long run, policy support, green transition trends, and technological innovation provide strong momentum for market development. However, in the short term, intensifying price wars, fluctuating tariff policies, and supply chain risks present challenges for all manufacturers in the industry.

FAQ

Why are e-bike sales declining if green transportation is being promoted?

While long-term trends are positive, the market is currently facing short-term pressures. These include post-pandemic market corrections, supply chain disruptions from geopolitical conflicts, and high inflation affecting consumer spending, which temporarily overshadow the benefits of green policies.

What are the biggest supply chain risks for e-bike companies?

The biggest risks include high tariffs on components from Asia, such as the EU's anti-dumping duties on Chinese goods, and logistical disruptions caused by global conflicts. There is also a heavy reliance on a few Asian suppliers for critical parts like motors and batteries, creating a significant vulnerability.

Is there still a market for high-end models like the electric dirt bike for adults?

Yes. While overall sales volumes are down, the average sales price for e-bikes has increased. This indicates that manufacturers are focusing on a market for high-end models like the electric dirt bike for adults, which have more stable demand and higher profit margins to offset the decline in mass-market sales.

How are companies adapting to these challenges?

-

Many are regionalizing their supply chains by moving manufacturing closer to their primary markets, such as setting up factories in Eastern Europe.

-

Brands are emphasizing "Made in Europe" as a mark of quality and a key selling point.

-

Companies are strengthening their brand competitiveness and developing precise localization strategies to capture opportunities in a new growth cycle.