Cambodia Now #1 US Bike Supplier as Tariffs Hit China

The U.S. bicycle market is undergoing a significant transformation in 2025. According to new data from the U.S. Census Bureau, U.S. bicycle imports (excluding electric bicycles) declined by 11% in value during the first half of the year. This drop comes as the industry grapples with escalating tariffs from Washington, leading to dramatic shifts in source countries.

Most notably, imports from China plummeted 42% year-over-year. In contrast, Cambodia surged 77% to $1.32 billion, overtaking China as the top supplier to the U.S. so far this year. These changes highlight how trade policies are forcing importers to adapt rapidly.

Key Takeaways

-

Overall Market Decline: U.S. bicycle imports (non-e-bike) fell 11% in value in the first half of 2025, driven by trade policy instability.

-

Cambodia is #1: Cambodia's exports to the U.S. surged 77% to $1.32 billion, making it the top supplier, replacing China.

-

China's Imports Plummet: Driven by tariffs, bicycle imports from China dropped a massive 42% year-over-year.

-

Tariff-Driven Volatility: Other countries saw direct impacts from tariffs. Taiwan fell 20% after a tariff hike, while Vietnam's exports were extremely volatile due to tariff uncertainty.

-

Supply Chain Diversification: Importers are actively shifting sourcing, with Malaysia, Indonesia, and India all reporting increases in bicycle exports to the U.S.

Shifting Supply Chains: A 2025 Snapshot

The first half of 2025 saw a total import value decline of 11% for all complete bicycles (this data does not include e-bikes). The dominance of China has rapidly eroded, paving the way for Southeast Asia's rise.

Key Country-by-Country Shifts

The impact of tariffs is not uniform; it has created clear winners and losers in the global supply chain.

|

Country |

Change in Exports to U.S. (H1 2025) |

Key Reason / Note |

|---|---|---|

|

Cambodia |

+77% (to $1.32 Billion) |

Became the #1 supplier to the U.S. |

|

China |

-42% |

Plummeted due to escalating Section 301 and other tariffs. |

|

Taiwan |

-20% |

Followed a tariff hike to 20% in April. |

|

Vietnam |

+0.1% (Near-flat) |

Extreme monthly volatility masks this flat figure. |

|

Malaysia, Indonesia, India |

Increase (unspecified) |

Signals a broader diversification of supply chains. |

For more on how similar tariffs are impacting the electric bike sector, see our related post on new 2025 U.S. tariff rates.

The Impact of Tariff Policies

These supply chain shifts are a direct response to U.S. trade policy. The threat of new tariffs on Chinese goods by the Trump administration, combined with existing Section 301 tariffs, continues to create uncertainty.

Since President Trump's April 2 announcement of a temporary 10% reciprocal tariff on imports from most countries, new rates have exceeded that baseline—Cambodia's rate, for example, is 19%.

Note: These policies are reshaping the industry. While they create opportunities for emerging manufacturing hubs like Cambodia, they also risk raising retail prices and curbing consumer demand in the U.S.

These changes also have regulatory knock-on effects. For insights on how other markets are adapting, read our analysis of 2025 e-bike regulation trends in Europe.

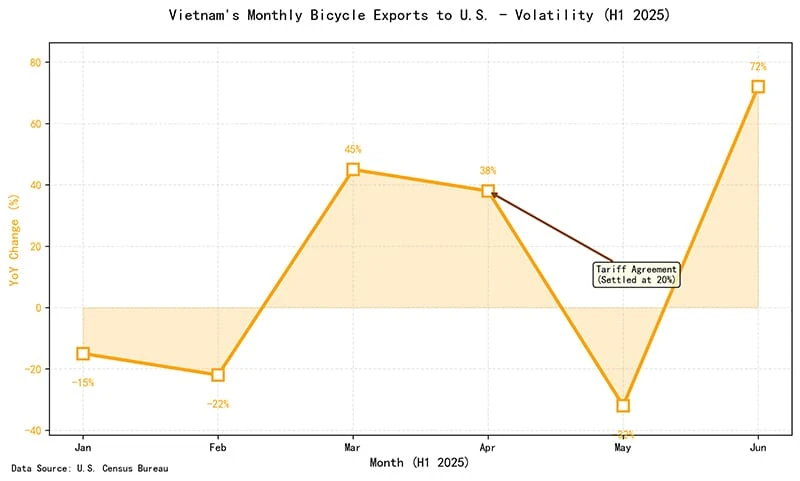

Case Study: Vietnam's Export Volatility

Vietnam's bicycle exports to the U.S. perfectly illustrate the instability caused by policy-driven markets. Despite a near-flat total (+0.1%), the monthly swings were extreme:

-

Jan, Feb, May: Significant drops (e.g., -32% in May).

-

March, April, June: Sharp rises (e.g., +72% in June).

This volatility is tied directly to tariff uncertainties, which were initially threatened at 46% before settling at 20% via a U.S.-Vietnam agreement. This case underscores the need for importers to monitor policy closely to optimize supply chains.

For the latest bike industry tariff updates from advocacy groups, visit PeopleForBikes' 2025 Tariff Update.

Outlook: The data from early 2025 reveals tariffs are profoundly altering U.S. bicycle imports. The industry is shifting from a China-centric model to a more diversified one. For businesses, understanding these dynamics is key to managing price volatility and supply risks.

FAQ

Why did U.S. bicycle imports from China drop?

Imports from China plummeted 42% in the first half of 2025. This is a direct result of escalating U.S. tariffs, including Section 301 tariffs, which make Chinese-made bicycles more expensive for U.S. importers.

Who is the new #1 bicycle supplier to the U.S.?

Cambodia. Exports from Cambodia surged 77% (to $1.32 billion) in the first half of 2025, allowing it to overtake China as the top supplier of bicycles to the U.S. market.

Does this import data include electric bikes (e-bikes)?

No. The U.S. Census Bureau data cited in this report covers complete bicycles but explicitly excludes electric bicycles, which are tracked separately.

Why were Vietnam's bicycle exports so volatile?

The volatility was due to tariff uncertainty. The U.S. initially announced a potential tariff of 46%, causing exports to fluctuate wildly. Once a U.S.-Vietnam agreement settled the rate at 20%, the market began to stabilize, but the period of uncertainty caused extreme monthly swings.