Chinese E-Bike Brand Enters Japan, Challenging Local Market in 2025

A major Chinese electric two-wheeler manufacturer is set to enter the Japanese market this November, according to Japanese media reports. The entry is strategically timed to coincide with stricter motorcycle emission standards in Japan, creating a significant market opportunity as local manufacturers discontinue older models.

Key Takeaways

-

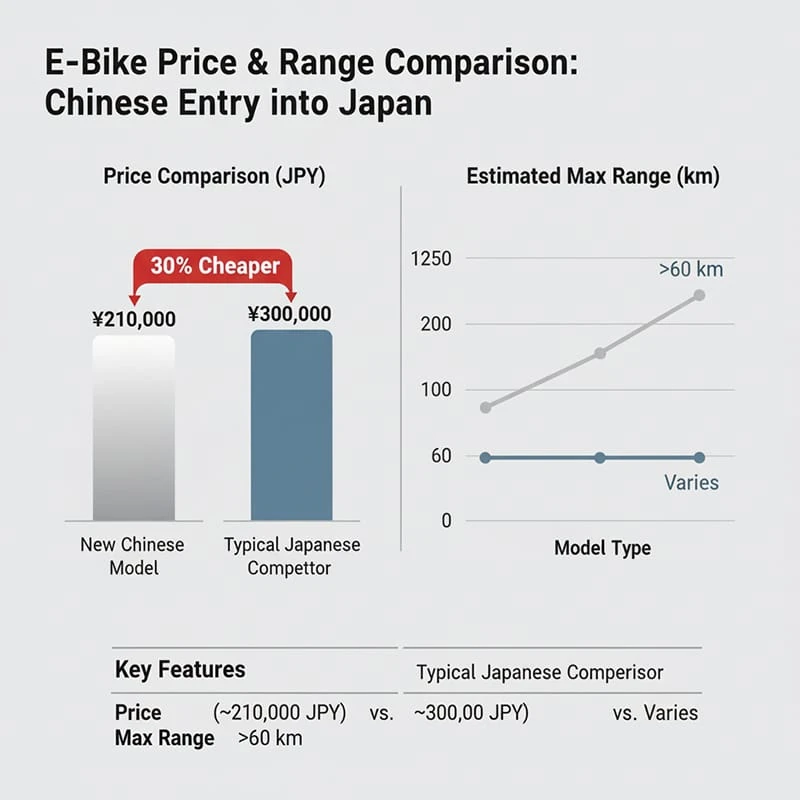

A leading Chinese e-bike company will launch in Japan in November with commuter models priced around 210,000 JPY, approximately 30% cheaper than comparable Japanese products.

-

The launch coincides with Japan's new, stricter emissions standards, which force local brands to halt production of non-compliant models, opening the door for new competitors.

-

While Japan's traditional motorcycle market has been declining, the push for decarbonization is accelerating a shift to electric models, with the global e-two-wheeler market share projected to reach 18.8% by 2035.

-

The move poses a direct challenge to Japanese domestic manufacturers, and its success could significantly impact the country's EV transition strategy and potentially open the market to other segments, like the electric dirt bike for adults.

-

This launch is backed by China's massive e-bike industry, which boasts over 973,000 related enterprises, indicating a powerful manufacturing and supply chain capability.

Strategic Timing and Competitive Pricing

Market Entry Details

The initial models from the Chinese manufacturer are designed for daily commuting, offering a maximum range of over 60 kilometers on a single charge. Their key advantage, however, is price. At approximately 210,000 JPY, they undercut domestic Japanese models by about 30%, a compelling proposition for cost-conscious consumers.

|

Feature |

New Chinese Model |

Typical Japanese Competitor |

|---|---|---|

|

Price |

~210,000 JPY |

~300,000 JPY |

|

Price Advantage |

Approx. 30% Cheaper |

N/A |

|

Max Range |

>60 km |

Varies |

This timing is critical. Japan's stricter motorcycle exhaust emission standards, effective in November, will make many existing gasoline-powered models obsolete. As local companies are forced to cease production of these older vehicles, a market gap emerges that this new entrant is perfectly positioned to fill.

Note: The success of these initial commuter models could pave the way for a broader range of products, potentially introducing Japanese consumers to specialized, high-performance Chinese models.

Japan's Shifting Two-Wheeler Landscape

Japan's once-thriving motorcycle market has faced a downturn in recent years, influenced by factors such as a declining birthrate and an aging population. However, the global push for decarbonization is creating a new trajectory. The market is steadily transitioning toward electrification. In 2024, electric models accounted for 8.5% of new two-wheeler sales globally, a figure expected to more than double to 18.8% by 2035.

Challenges and Market Impact

Despite the opportunity, the Chinese brand faces significant challenges. Japanese domestic companies are not standing still; they are actively promoting their own electrification strategies, investing heavily in research and development, and setting ambitious sales targets.

If this new entrant achieves strong sales, it could have a major impact on Japan's electrification strategy, potentially accelerating the transition and increasing competition. A successful launch could also build brand trust, creating future demand for other niche segments where Chinese manufacturers are strong, such as the off-road electric dirt bike for adults.

The scale of China's domestic industry provides a formidable backbone for this expansion. According to data from Tianyancha, there are currently over 973,000 active e-bike-related enterprises in China. The provinces of Beijing, Jiangsu, and Guangdong alone account for over 30% of this total, showcasing a deep and concentrated manufacturing ecosystem.

🛠️ Tip: The sheer volume of manufacturers in China creates intense domestic competition, which drives innovation and cost reduction—advantages that can be leveraged in export markets like Japan.

FAQ

Why is November a good time for a Chinese company to enter the Japanese market?

November marks the implementation of stricter motorcycle emission standards in Japan. This forces local manufacturers to stop selling many of their popular gasoline-powered models, creating an immediate market gap for new, compliant vehicles like electric bikes.

What is the biggest challenge the Chinese brand will face?

The primary challenge will be competing with established Japanese domestic brands like Yamaha and Honda, which have strong brand loyalty and are also investing heavily in their own electric vehicle lineups. Building consumer trust will be crucial.

Could this lead to other types of Chinese e-bikes, like an electric dirt bike for adults, being sold in Japan?

It's possible. If the initial commuter models are successful and the brand establishes a reputation for quality and reliability, it would create a pathway to introduce a wider portfolio of products. This could include niche, high-performance models like the electric dirt bike for adults, which are popular in other global markets.

How large is China's e-bike industry?

It is massive. Professional data indicates that as of today, China has over 973,000 active companies related to the manufacturing and sales of electric bicycles, demonstrating incredible industrial capacity.