E-Bike Market Trends 2025: Challenges & New Growth Segments

The Global Sources Consumer Electronics Show opened on October 11th at Hong Kong's AsiaWorld-Expo. As one of the world's most influential consumer electronics exhibitions, this event centered on the theme "Explore Future Tech & Enjoy Leisure." It featured three professional shows running concurrently: the Gaming Show, Consumer Electronics Show, and Electronic Components Show. The exhibition covered a vast range of product categories, including AV, automotive electronics, computer peripherals, outdoor electronics, and gaming.

The show attracted over 2,000 high-quality suppliers from around the world, displaying approximately 150,000 innovative products. It provided a rich procurement platform for both the consumer electronics and electronic components industries. The first phase of the exhibition was expected to attract over 60,000 global B2B buyers, with over 40% of attendees coming from Europe and the United States.

Key Takeaways

-

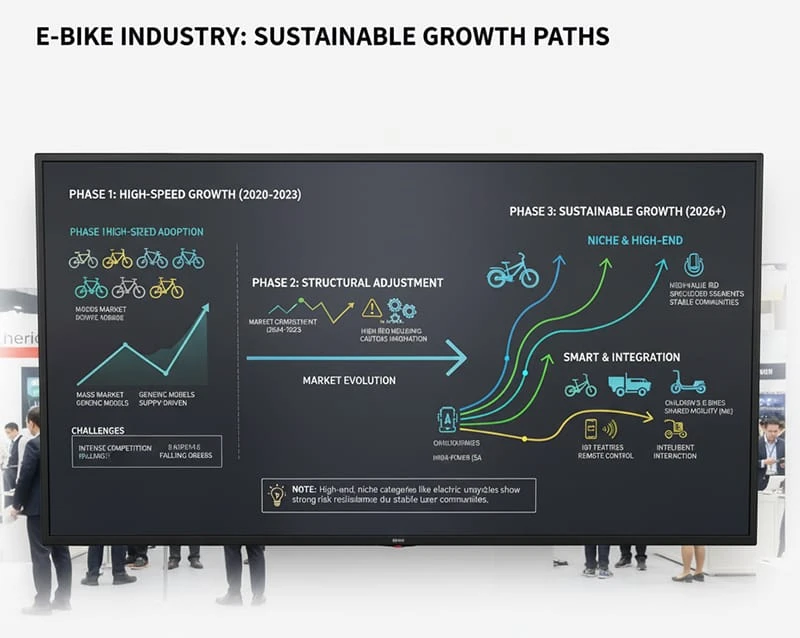

The e-bike market is facing a challenging adjustment period with falling orders and intense competition after a phase of high-speed growth.

-

High R&D costs and market risks are making manufacturers more cautious about launching new models, especially with high molding fees at stake.

-

The US market is slow due to economic factors and tariffs, while the EU market remains strong but has high barriers to entry due to strict quality and safety standards.

-

New opportunities are emerging in South America (for high-power models like the adult electric dirt bike) and the Middle East (for shared mobility).

-

Key growth segments include the children's e-bike market and high-power models, as demand for smart, feature-rich e-bikes becomes standard.

Micro-Mobility Sector Insights

Show Floor Highlights

The micro-mobility industry exhibition area was once again located in Hall 11. This smart mobility zone became a key stage for technological innovation, featuring popular categories like personal mobility devices, balance scooters, and light electric motorcycles. As usual, a dedicated test-drive area was set up for product demonstrations and performances.

Current Market Challenges

Currently, the global electric bicycle (e-bike) and micro-mobility market is entering a new phase of challenges and structural adjustment following a period of rapid growth. Based on discussions with exhibitors, it's clear that market competition has become white-hot. Overall order volume is trending downward, placing traditional manufacturers under significant pressure.

Against this backdrop, companies are becoming more cautious about new product development. The entire process, from mold design to a successful market launch, can take a year or even longer. This period requires substantial investment in personnel, materials, and finances, all while bearing the risk of market changes. Furthermore, molding fees are expensive; if a product fails to resonate with the market, the initial investment is lost. This has made manufacturers far more hesitant to release new products.

Global Market Headwinds

|

Region |

Market Conditions & Challenges |

|---|---|

|

United States |

Current performance is lackluster. Slow economic growth and tariff impacts are the main obstacles. This leads to shrinking orders and fewer customers. Vendors with high-value products and sufficient inventory have a larger buffer but still face widespread pressure to reduce prices. |

|

Europe |

Europe remains a critical e-bike market. However, the region has strict standards for product quality, safety, and environmental protection. Many wonder "are e bikes street legal?" and the high certification thresholds limit entry for some manufacturers. For companies already established in Europe, they must continuously improve product quality and technology to cope with fierce competition. |

Finding Growth in a Tough Market

Even in a challenging market, promising opportunities are emerging. These can be viewed from the dimensions of both markets and products.

New Regional Demand

From a global perspective, South America is showing strong demand for high-power models, highlighting unique market preferences. Due to complex local terrain and poor road conditions in some areas, powerful e-bikes are better suited to meet user needs. This has prompted several manufacturers to accelerate their layout in this segment, especially for models like the adult electric dirt bike.

Meanwhile, shared mobility businesses are rising rapidly in emerging markets like the Middle East, where shared e-bikes are gaining popularity. This region also shows future potential for R&D into high-performance electric motorcycles and e-bikes.

Hot Product Segments

Companies are actively exploring new growth by focusing on product innovation and market segmentation.

-

Children's Market: This segment is performing exceptionally well. While the global e-bike market slows, the children's segment has shown explosive power. For example, Austrian children's bike maker Woom reported H1 2025 revenue of 90.1 million EUR, a 41% year-over-year increase. More manufacturers are launching micro-mobility products for kids, blending fun designs with educational features to meet parental demands. This contrasts with the market for the electric mini bike for adults, which serves a different niche.

-

Power Models: This category has a new window of opportunity. Many companies are developing e-bikes with stronger performance to handle complex road conditions, catering to the market's preference for "power-assisted" products. This includes everything from the street legal electric bike to more powerful off-road models.

-

Smart Features: User demand for smart functionality continues to rise. Features like intelligent interaction and remote control are moving from being "bonus points" to "standard configuration."

Future Outlook

Note: Under the slowing growth, some high-end, niche categories (like electric unicycles) are showing strong risk resistance thanks to stable user communities.

Companies that continue to invest in high-barrier, high-value-added R&D are also maintaining profitability despite homogenous competition. While the market is increasingly complex, the industry can still find a high-quality, sustainable development path. This path relies on market diversification, smart upgrades, and segmenting products for specific scenarios, whether it's cheap electric dirt bikes for adults or high-end commuter models.

The 2025 Hong Kong Global Sources Autumn Show provided a snapshot of an industry actively innovating under pressure. The show may be over, but the innovation and exploration in the two-wheeled industry never stop.

FAQ

Why are e-bike companies cautious about releasing new models?

Manufacturers are cautious because the R&D process can take over a year and requires a large investment. Molding fees are particularly high, and if a new product fails in the current competitive market, the financial loss can be significant.

What are the fastest-growing segments in the e-bike market?

Despite a general market slowdown, the children's e-bike market is showing explosive growth. There is also a rising demand for high-power models, such as those that can reach ebike 40 mph, designed for complex terrain and users seeking stronger performance.

Are e-bikes street legal in major markets?

The question "are e bikes street legal" is a major factor. In Europe, for example, products must meet strict quality, safety, and environmental standards to be legal for sale and use. These high-barrier certifications can be a challenge for some manufacturers. You should always check your local laws.

Which new regions show potential for e-bike sales?

-

South America: Shows strong demand for powerful models, like the street legal electric dirt bike, due to varied terrain.

-

Middle East: This market is seeing a rapid rise in shared e-bike services and has future potential for high-performance models.