Trump 100% China Tariff Threat: How E-Bike Prices Are at Risk

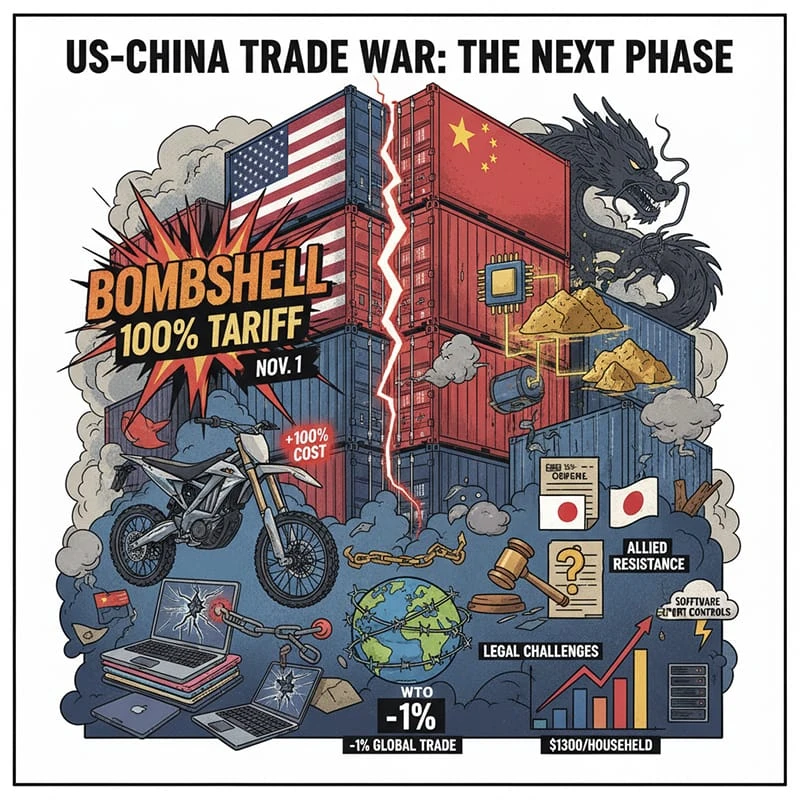

On October 10, President Donald Trump dropped a tariff "bombshell" on his Truth Social platform, announcing that the U.S. would impose a 100% import tariff on all Chinese goods starting November 1. This new duty would be "layered" on top of existing tariffs.

Key Takeaways

-

Donald Trump has threatened a new 100% tariff on all Chinese imports, set to begin November 1, layered on top of current duties.

-

The proposed tariff covers all categories, including consumer electronics, machinery, and recreational products like the electric dirt bike for adults, which would see a massive price increase.

-

In parallel, Trump announced export controls on "all key software," a move seen as retaliation against China's tightening control over rare earth mineral exports.

-

China has already implemented countermeasures, including stricter export controls on its dominant rare earth supply chain and launching an antitrust investigation into Qualcomm.

-

Despite the threat, significant hurdles exist for implementation, including the high cost to U.S. consumers, legal challenges, and resistance from allies, suggesting this may be a high-stakes negotiating tactic.

Trump's Tariff Threat and Justification

Trump cited China's "aggressive stance" in trade as the reason for the drastic measure. The proposed tariff is exceptionally broad, designed to apply to all goods imported from China. This includes traditional sectors like consumer electronics, industrial machinery, and textiles, as well as popular recreational vehicles. The price of an imported electric dirt bike for adults, for example, could more than double if the tariff is enacted.

Simultaneously, Trump announced that on the same day, the U.S. would implement export controls on "all key software." This is widely interpreted as a direct countermeasure to China's recent move to tighten its own export controls on rare earth minerals.

The Rare Earth Standoff

In an interview, U.S. Secretary of the Interior Doug Burgum stated that China currently controls between 85% and 100% of the refining capacity for 20 of the most critical rare earth minerals. "If they choke off the lifeblood of these markets, we must have a way to break that hold," he said. Data shows that China supplies approximately 70% of the world's rare earth minerals, which are vital for the defense, semiconductor, and renewable energy industries.

|

Action |

Stated Reason / Context |

|---|---|

|

U.S. Threat: 100% Tariff on all Chinese goods |

Response to China's "aggressive stance" in trade. |

|

U.S. Threat: Export controls on key software |

Retaliation for China's rare earth export controls. |

|

China's Action: Export controls on rare earths |

Described as a normal act of perfecting its legal export control system. China refines ~85-100% of key rare earths. |

China's Response and Preemptive Measures

In response to Trump's tariff threat, a spokesperson for China's Ministry of Commerce stated on October 12 that Beijing has noted the situation. The spokesperson emphasized that China's previously announced export control measures on rare earths are a normal action taken to perfect its own export control system in accordance with its laws and regulations.

Even before Trump's threat, China had already taken a series of countermeasures between October 9 and 10:

-

Implementing "global jurisdiction" export controls over the entire rare earth supply chain, including mining, technology, and smelting.

-

Launching an antitrust investigation into the U.S. tech company Qualcomm.

-

Imposing a "special port service fee" on U.S.-flagged vessels.

Significant Headwinds to Implementation

Despite the dramatic announcement, Trump's threat appears to be a familiar tactic of "maximum pressure," and its actual implementation faces significant obstacles.

-

Economic Impact: Moody's data from the 2018 trade war showed that U.S. consumers bore 92.4% of the tariff costs, increasing annual household expenses by $1,300. A 100% tariff would cause a sharp spike in inflation and likely trigger a strong public backlash.

-

Legal and Allied Resistance: In July 2025, a U.S. federal court ruled that Trump's previous tariff policy was an overreach of authority. Furthermore, allies like the European Union and Japan have already secured trade agreements with the U.S. and are unwilling to be drawn into a new trade war.

-

Global Opposition: The World Trade Organization (WTO) has warned that such a tariff war could cause global trade volume to shrink by 1% in 2025.

While Trump's tariff threat may simply be a bargaining chip, the future of this trade conflict remains to be seen.

FAQ

What specific products would be affected by the 100% tariff?

The threat is comprehensive and applies to "all" goods imported from China. This would include everything from iPhones and laptops to clothing, furniture, and recreational products. For consumers, this means the cost of an imported electric dirt bike for adults could potentially double overnight.

What are rare earth minerals, and why are they important?

Rare earth minerals are a group of 17 chemical elements crucial for manufacturing high-tech products. They are essential for magnets in electric motors (including those in e-bikes), semiconductors, defense systems, and batteries. China's dominance in their refining gives it significant geopolitical leverage.

Is this tariff likely to actually happen?

It faces major obstacles. The economic cost to U.S. consumers would be immense, leading to high inflation. There are also legal challenges regarding presidential authority to impose such broad tariffs, and U.S. allies in Europe and Asia would likely oppose it. Many analysts view it as a negotiating tactic rather than a certainty.

How did China respond before Trump's announcement?

China took several preemptive actions, including tightening its control over the global rare earth supply chain, opening an antitrust probe into U.S. chipmaker Qualcomm, and imposing special fees on American ships.